The Super-App

The most popular instant messenger apps in Asia have evolved to become platforms in their own

right. With APAC consumers accessing the Internet primarily through their smartphones, it is not

surprising that they have become easily accustomed to performing multiple, often seemingly

unrelated functions with just one app – the Super-App.

The smartphone Super-Application represents one of the most significant technological innovations

to have evolved in recent years. It offers users the ability to communicate, shop online, read books,

play online games, get food delivered and pay for virtually anything within the app.

The Super-App has helped to spark the beginning of a “cashless revolution”, where consumer

payments nowadays are predominantly made via mobile phone – especially in China.

One could define the Super-App as consisting of a variety of apps integrated into one massive

umbrella app. Some experts believe that it cannot even be called an actual an app, but rather a

whole underlying operating system for mobile phones.

Giants emerge

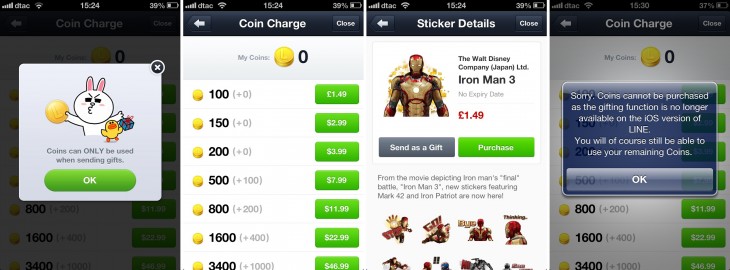

In Asia, the two main examples for powerful Super-Apps are Grab and Line.

Today, there are over one billion users on WeChat that have sent over 45 billion messages (Source:

ZDNet and China Daily), whereby more than two thirds of the Chinese are using it for multiple

sessions per day on average, and there are more than a hundred million Chinese using the app

outside the country’s borders.

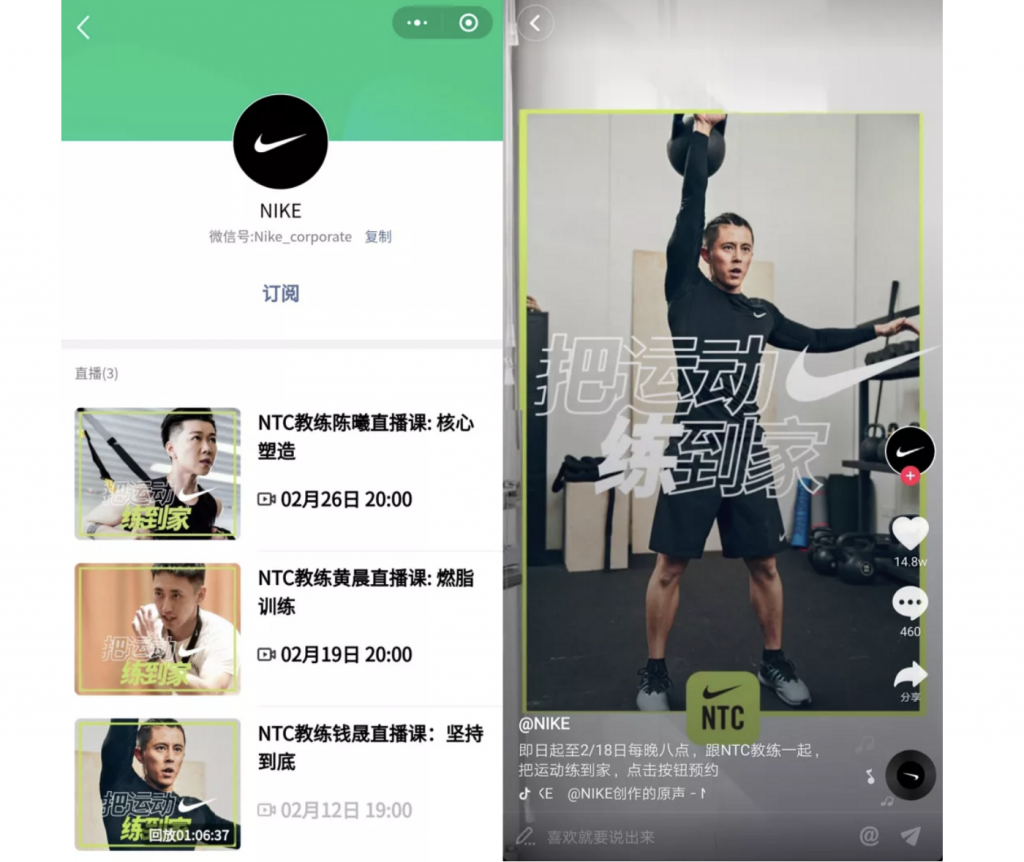

Utilization varies widely and includes everything from media sharing to social media contributions,

bookings for movies, taxi calling, payments, video calls, shopping and more. Furthermore, when

WeChat launched its mini-program a couple of years ago, it has enhanced the functions of the

platform since the last major addition of WeChat Pay in 2013, which then sparked China’s cashless

revolution.

While expert opinions are split on whether the Super-App concept actually started with WeChat, or

if it dates back to a time before it was launched, there is no denying how WeChat has grown to

become a dominant force which impacts a large part of the daily lives of people in mainland China.

The below statistics further showcase the power and dominance of WeChat:

Key WeChat Statistics

- WeChat reported reaching 1 billion daily active users in January 2019 (ZDNet)

- WeChat the fifth most-used social app in the world (Hootsuite/We Are Social)

- In Q4 2019, WeChat reported a 15% year-on-year increase in daily messages sent increased (Tencent)

- WeChat accounts for 34% of total mobile data traffic in China (Walk the Chat)

- Around 30% of mobile internet time in China is spent on WeChat (CNBC)

- 10 billion hits on WeChat Moments every 24 hours (TechNode)

- 83% of WeChat users use the general app for work (ChinaChannel)

- Daily active WeChat mini programs users at over 300 million in 2019 (China Internet Watch)

- WeChat mini program monthly active users at 746 million in June 2019 (Walk the Chat)

- WeChat mini programs generated 800 billion RMB in 2019, with average daily transaction volume doubling year-on-year (Walk the Chat)

- Over 1 million WeChat mini programs by the end of 2018 (TechCrunch)

- WeChat Work used by 2.5 million companies and 60 million MAU (China Internet Watch)

- 1 billion WeChat Pay commercial transactions per day in Q4 2019 (Walk the Chat)

- 72 million businesses registered to WeChat Pay in 2019 (China Internet Watch)

- 50 million monthly active merchants on WeChat Pay in Q4 2019 (Tencent)

Key Line Statistics

- 194 million LINE users globally at the beginning of 2019

- 164 LINE MAU in key markets of Japan, Taiwan, Indonesia, and Thailand in Q2 2019

- 80 million LINE MAU in Japan

- 79% of MAUs are DAUs

- 2.5 million LINE users in the US

- LINE Pay users numbered 7.4 million in Q2 2019 – a 118% year-on-year increase

- 5 million LINE Pay users in Japan

- LINE Pay transaction volume stood at ¥286 billion in Q2 2019 – up 10% year-on-year

- 11 million LINE Music users, with 32 million app downloads

- LINE Manga downloaded 23 million times

- 7.8 users read one of 2,900 original works on LINE Manga’s Free Service every second

- LINE Manga revenue came to ¥6.3 billion ($59 million) in Q2 2019, while LINE MUSIC generated ¥2.6 billion revenue ($24 million)

- 78.8% growth year-on-year in LINE shopping transaction volume reported in Q2 2019

- Food transaction volume increased 76.3% year-on-year in Q2 2019

- Travel related transaction volume grew 85.4% quarter-on-quarter in Q2 2019

- LINE revenue for Q2 2019 came to ¥55.4 billion ($518 million); a 9.5% increase over Q2 2018

- 55% of LINE revenue in Q2 2019 came from advertising, 32% from communication/content/other, and the remaining 13% from ‘strategic business’

- As of Q2 2019, 74% of LINE revenue was generated in Japan, and 26% overseas

- Q2 2019 LINE ad revenue came to ¥30.7 billion ($285 million), a 12.9% increase year-on-year

- Total LINE revenue for 2018 came to ¥207.2 billion ($1.9 billion)

- LINE shares were trading at $38.61 on the NYSE in September 2019, giving LINE a market cap of $9.4 billion

- The contemporaneous LINE price on the Tokyo stock exchange was ¥4155, with a market cap of ¥1 trillion

Key Takeaways

In Asia, these new unified Super-Apps are defining innovation and technology and there are no signs of this progress slowing down in the near future.

Further distinctive platforms that have sprung up in the region include Indonesia’s Go-Jek and Singapore’s Grab, two of the largest start-ups in Southeast Asia, each developing their own services and combining them all into a single powerful super-application.

WeChat from Tencent Holdings Ltd. is the king of super-apps, with over 1 billion people accessing it at least once a month. While Grab and Go-Jek originally started out as Ride Hailing platforms, they soon expanded into apps that offer other services related to payment transactions.

Today, China is the clear leader in the region in platform development, and many of the Chinese technology companies such as Baidu, Alibaba, Tencent and Bytedance have not only developed their platforms, but have gone beyond them, building ecosystems of connected communities, seamless services and new technology-based interfaces. Alibaba continues to advance its ecosystem development by unleashing the power of cloud computing and artificial intelligence to deliver business opportunities while advancing into the connected household.

We see that the introduction of new technologies in the APAC region continues to outperform the West. As the price of smartphones and data continues to fall, we see the technology becoming more commoditized.

By utilising the data that users of multi-purpose applications produce, these providers can gain more insight into their day-to-day business and leverage this information to offer new products and services. Digital assistance and other services are among the most important building blocks that will begin to harness the power of automated intelligent systems.

Are you interested in how your business can get involved and utilise these kinds of technologies to open up new markets and opportunities in Asia?

Dejavu has experience working in most Asian markets, including China, Hong Kong, Macau, Taiwan, Singapore, Japan, South Korea, India, Thailand, the Philippines, Malaysia and Indonesia.

We provide personalized branding, marketing, and digital services to enable your brand to be become a success in the East.

We speak the language. We’re conscious of the global economy.

We understand your market.